Do you want to invest in stocks and bonds but don’t know where to start? Perhaps you’re hesitant to invest because you don’t understand stocks, bonds and mutual funds.

If getting a toehold in the world of investments seems like a big step to you, mutual funds may offer convenient, cost-effective access to the world of professional money management.

Simply stated, mutual funds pool money from you and other investors to buy securities- stocks, bonds and other investment vehicles that are publicly traded in financial markets around the world.

A Mutual Fund:

- Is run by investment professionals.

- Invests according to the fund’s investment objective.

- Can have an investment objective ranging from conservative to aggressive — conservative funds generally earn smaller returns with less risk, while aggressive funds generally offer potentially higher returns with greater risk.

A financial distributor can help you determine the types of funds that are most appropriate for you based on your current financial circumstances, investment goals, time horizon and attitude toward risk.

- The first mutual fund in the India was created with formation of UTI in 1963 by an Act of Parliament and functioned under the Regulatory and Administration control of the RBI.

- Currently, the Securities Exchange Board of India (SEBI) regulates mutual funds.

Four Reasons to Own Mutual Funds

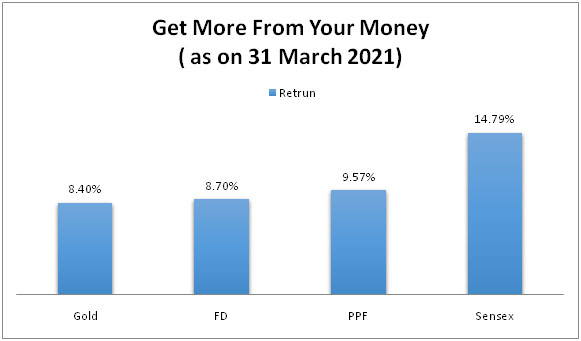

As the chart below illustrates, the long-term growth of stocks are historically been greater than that Gold, Fix deposit (FD), Public Provident Fund (PPF).

** Average Annual Total Returns of Different Assets Class in Last 40 years.

This chart is for illustrative purposes only and does not reflect the performance of a specific investment or asset. Past performance cannot guarantee comparable future results.

In this illustration, PPF, FDs are represented by the 1 Year maturities and are short-term investments that pay fixed principal and interest, but are subject to fluctuating rollover rates and early withdrawal penalties. Gold and Sensex (shares Index) are not insured, and their value will vary with market conditions. An investment cannot be made directly in an index.

Mutual funds may earn money for you in two ways:

- Appreciation (Growth). Your fund units increase in value or appreciate — when securities the fund owns increase in total value.

- Income distribution cum capital withdrawal (Dividends). Unit holders may receive dividends when companies the fund invests in distribute a portion of their profits result when fund managers sell securities owned by the fund at a profit or the fund receives other investment income. As a unit holder, you can choose to receive dividend or reinvest dividends in the fund. Name of “Dividend option” has been changed to “Income Distribution cum Capital withdrawal option”. As the chart below illustrates, reinvesting dividends may significantly increase the value of your assets.

To Reinvest or Not to Reinvest?

Assuming an initial investment of Rs 10,000 and an annualized hypothetical total return of 8%, the chart shows the difference between a portfolio with dividends taken as cash and one in which dividends were reinvested.

Data shown do not include principal amount of Rs 10,000.This chart is for illustrative purposes only and does not reflect the performance of a specific investment or fund.

Diversification may help protect you from market highs and lows because you’re not too heavily invested in one company or industry. In other words, all of your eggs aren’t in one basket. Mutual funds allow you to spread out, or diversify, your assets among a variety of investments so you can take advantage of strong areas of the market and minimize your risk when other areas of the market perform poorly.

Because there is no way for anyone to predict which companies and industries will perform well; diversification is the best way to balance your portfolio and is a key component of financial success.

Mutual funds are typically headed by a portfolio manager who is supported by a team of experienced investment professionals. This team bases its buying decisions on extensive, ongoing research and analysis. This means that you don’t have to spend thousands of hours performing your own research.

Mutual funds offer a number of convenient features, including:

Liquidity. Buying and selling mutual fund shares is as easy as picking up the phone or going online. Your money is readily accessible because mutual funds are liquid assets. Units may be redeemed for current market value any day the Stock Exchange is open.

Exchange privileges. Within a fund company (AMC), you can generally move portions of your investment into other funds with different objectives as your financial situation changes.

Systematic Investment Plans. Investing the same amount of money on a regular basis, such as weekly or monthly, is a convenient way to benefit from changing market prices. As market prices go up and down, your regular investment will buy some units at a lower price and some at a higher price. Over time, the price per units will average out. This is called Rupee-cost averaging.

It allows you to potentially own more units over time at a cheaper price than if you bought all of your units on one day with one lumpsum of money.

It’s important to note that Rupee-cost averaging does not ensure a profit or protect against loss in declining markets. Since rupee-cost averaging involves continuous investing regardless of fluctuating security prices, you should consider your ability to invest over an extended period of time.

Establish Your Financial Goals

Before you enter the world of mutual funds, it’s crucial that you meet with a financial distributor to discuss your financial goals. Your distributor uses these goals to help you create a plan for building wealth. Periodic meetings with your distributor especially when your financial goals or circumstances change help ensure that your investment strategy meets your needs. As you prepare to meet with your financial distributor,

ask yourself the following questions:

Perhaps you’re saving for a house, your child’s college education or retirement. These are all considerations that affect how much risk you can afford to take and what funds you buy.

You may not have much to invest right now, but you may be able to invest as little as Rs 500 per month in mutual funds. Whatever your situation, a financial distributor can help you create a plan to start saving to achieve your goals.

All mutual funds carry a certain amount of risk, including the possible loss of your investment.

Generally, the longer it is until you need your money, the more risk you can afford to take. Your financial distributor can help you decide how much or how little risk is appropriate for your situation.

Once you have answered these questions, you’ll have a good outline of where you want to be financially. Now you can explore which mutual funds may help you get there.

With so many types of mutual funds, how do you know which ones to choose? That depends on your financial goals, time frame and risk tolerance. Your financial distributor can help you to create a well-balanced portfolio that includes a mix of different types of mutual funds.

Stock or equity funds invest primarily in shares of Indian company stocks, and some even focus on companies within a specific industry or sector. Companies range from small, emerging businesses that show promise to large, well-established companies with strong financial structures. There are many types of stock funds that offer varying degrees of risk and return potential.

Bond Or Debt funds invest primarily in short and long-term securities issued by government, public financial institutions, companies Treasury bills, Government Securities, Debentures, Commercial paper, Certificates of Deposit and others. They are typically designed to protect principal and provide income through regular dividend payments. While most bond funds are on the conservative end of the risk spectrum, some fall into higher risk categories.

Balanced Or Hybrid funds invest in both stocks and bonds to balance the growth potential of stocks with the relative stability of bonds.

Money market Or Liquid funds invest in securities such as Treasury bills and CDs that mature in about 91 days or less. They are considered to have minimal risk, and their returns are typically just a bit higher than those of savings accounts. Investments in money market funds are not insured or guaranteed by the Deposit Insurance scheme or any other government agency.

Although mutual funds are not guaranteed or insured, they are heavily regulated under securities laws.

Spreading your mutual fund investments across different asset classes — such as stock, bond and money market funds — is called asset allocation.

This strategy is an important part of investing because it helps balance the risk and return of your portfolio to meet your financial goals.

Your risk tolerance and time horizon or when you will need your money helps determine how you should allocate your assets. For example, if your goal is to save for a down payment on a house in three years, you would invest your money differently than if your goal is retirement in 15 years.

Based on need one can construct three types of portfolios,

The conservative investor is typically interested in preservation of capital, receiving steady investment income and beating inflation over the long term. This investor has a low risk tolerance and is particularly sensitive to short-term volatility.

The moderate investor is less sensitive to short-term volatility than the conservative investor and is interested in receiving steady investment income and preserving capital.

The growth investor is typically seeking higher relative return. Because he or she usually has a relatively long time horizon and high risk tolerance, the growth investor is not as concerned about short-term volatility.

How Do I Get Started?

Now that you’ve learned a bit about mutual funds, you want to get started. Don’t go it alone.

Of all the investment decisions you’ll make, the most important one may be to work with a financial distributor, who will help you and maintain your strategy when markets become volatile. It’s only human for investors to become distracted by short-term events or market trends. An experienced distributor can keep you focused on the long term.

A Word About Risk

- Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

- An investment in commodities has special risks associated with it, including market price fluctuations, regulatory changes, interest changes, credit risk, economic changes and the effect of adverse political or financial factors.

- Foreign securities have additional risks, including exchange rate changes, political and economic upheaval, the relative lack of information about these companies, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Consider the investment objectives, risks, and charges and expenses carefully. For this and other information about mutual funds, obtain a prospectus, SID, and KIM from us or read it online carefully before investing.